China is not only the Asian giant, but an economic titan that questions the Western order. Although in 2004 Chinese investment abroad barely accounted for 0.45% of world flows, the communist regime has escalated to become the second largest investor country, just behind the United States, representing 12.8% of the global total in 2018.

While the main destinations of Chinese capital are Hong Kong, USA. and Singapore, that same year, in Spain there was the fifth largest investment by size in Europe, when the Chinese fund Orient Hontai Capital bought 53.5% of the audiovisual production company Imagina Media for 1,106 million euros. And, in just three years (between 2015 and 2018), its investments exceed 4,000 million euros.

However, the commercial tensions, the capital controls of the Beijing regime and the increasing regulation in the countries receiving the investment have collapsed the good numbers of recent years. Thus, Chinese investment in Spain has plummeted 99% in the first half of 2019, with just 10 million dollars (around 9 million euros), as reflected in the latest report of the Baker McKenzie law firm. However, China is the seventh country that invests most in Spain - 4.3% of the total, according to the Secretary of State for Commerce - and a single operation of similar magnitude to last year could recover the figures.

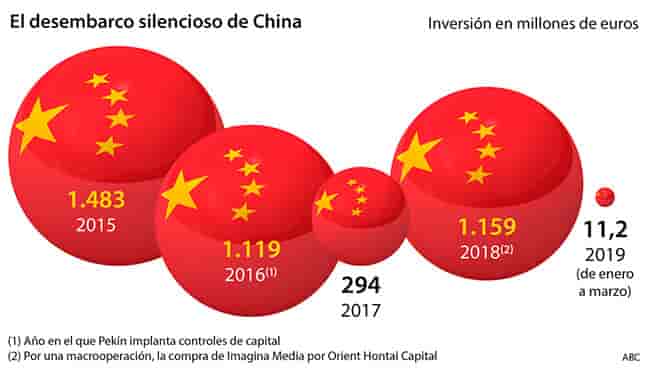

The official data of the Foreign Investment Registry point in the same direction. In 2018, China's gross investment in Spain totaled 1,159 million euros (thanks to a macro operation), compared to 294 million euros in 2017, 1,119 million euros in 2016 and 1,483 million euros in 2015. And between January and March of this year fell to 11.2 million.

Meanwhile, Chinese investment is declining across the globe; In 2018, it was 18% lower than the previous year, according to UN data.

On the one hand, this setback responds to the capital controls implemented, as of 2016, by the Beijing regime to avoid speculative inflows and outflows of money, which could destabilize the Chinese economy, which has stopped chaining for five years. double digit growth figures. These financial restrictions only allow specific investments, of strategic interest to Chinese companies, and prohibit the growing middle class - GDP per capita is expected to exceed $ 12,235 in 2022 - to extract more than $ 50,000 a year from the country. But this does not prevent the proliferation of practices to avoid the legal limit in search of profitability.

The majority of Chinese people invest in Spanish brick to obtain the "golden visa", created by the Government of Mariano Rajoy in 2013, a residence visa for non-EU foreigners whose real estate investments exceed 500,000 euros. It occurs, above all, in large cities such as Madrid and Barcelona, where there is "more activity of this group," says Juan José Aguilera, of the Official Association of Real Estate Agents (COAPI) of Barcelona. "The Chinese citizen seeks a place where he has comfort, good services, good schools for his children, ability to enter a system that allows them to generate trade and wealth," explains Aguilera, who says that Spain meets those requirements.

More sophisticated businesses

Thus, apart from the large operations of companies and some funds, weighed down by state pressure, more and more individuals carry out small operations. If retail stores ("all-hundred") and restaurants proliferated before, now, "the Chinese community is becoming sophisticated," explains Carlos Sentís, CEO of Henkuai, the main Spanish communication and relations company between Spain and China.

From small wineries to insurance sales companies, businesses in the hands of Chinese to meet the demand of their own community outside their country of origin. "In Barcelona, we already have enough real estate agents run by people of this nationality," says Aguilera. A way to serve their compatriots and overcome the main cultural barrier, the language, for those who bet on investing in Spain. Similarly, large transactions also broaden its horizon and are introduced in sectors such as "tourism, infrastructure, health, food and soccer equipment," Sentís adds.

To date, the attempt by the Spanish Government to attract Chinese investment "has not been anything proactive, strategic, or intense," Sentís says, given that each region has acted on its own and, on occasion, has put obstacles to the business. As was the case with the historic Spain building, which the Chinese Wanda group had to sell after the obstacles of the City Council of Manuela Carmena.

In fact, in 2018, the number of “gold visas” granted reached its historical low, according to the Registrar's Association. "We are already talking about immigration strategy, requirements to bring these capitals and these citizens," says Aguilera. Competing countries like Portugal and Italy are more agile when it comes to attracting investment, which ultimately depends on "political will."

The UE position

Of course, the other side of the coin is the commercial war between Washington and Beijing, inflamed in recent weeks by the new tariffs imposed by Donald Trump and the devaluation of the yuan as a counterattack. Thus, although until recently the countries wished to receive Chinese investment, "the current bipolarity forces to choose", indicates Sentís. And Spain plays with the European Union, which has declared China its "strategic competitor and systemic rival", a "barbarity", in the words of Sentís, which can cause the Old Continent to close the doors - yet open wide to the capital of the Asian giant.

Digital Newspaper ABC